Nancy Kelly brings a unique and multifaceted background to the accounting profession. She began her career as a registered nurse in the operating room at St. Elizabeth’s Hospital in Boston, where she developed a deep appreciation for precision, discipline, and resilience—qualities that would later define her success in the world of accounting for not-for-profits.

Recognizing the critical role financial resources play in sustaining meaningful change, Nancy made the transition from healthcare to accounting, earning her accounting degree from Boston College and master’s degree from Bently College in Taxation. Early in her accounting career, Nancy worked closely with AIDS service organizations, where she combined technical expertise with a passion for education—making complex accounting principles accessible and actionable for nonprofit leaders. Her entrepreneurial spirit eventually led her to establish her own accounting firm, where she emphasizes integrity, collaboration, and a workplace culture that values both excellence and inclusivity.

Nancy is recognized for her expertise in Uniform Guidance audits and has been approved by the American Institute of Public Accountants (AICPA) where she serves as a peer reviewer. She has experience in the must-select areas of the Uniform Guidance, Yellow Book and ERISA. She is an active member of the New England Peer Review Board, where she helps uphold professional standards and improve audit quality across the region. Working in the not-for-profit sector Nancy decided it was necessary to gain a deeper understanding of the elements of fraud, by which she attained her certificate as a Certified Fraud Examiner.

Beyond the office, Nancy is an accomplished quilter, applying the same attention to detail and creativity in her art as she does in her professional work. A lifelong learner, she further sharpened her skills at Harvard Law School, completing the Negotiation and Leadership program to better serve clients in complex financial discussions and address partnership disputes. Nancy’s career is a testament to the power of reinvention, combining compassion, empathy, resilience, technical skill, and leadership in service to her clients and community.

Jon grew up in a community where he learned to make homemade ice cream in the cornerstone of his family-owned business. By the age of 12, he entered the world of entrepreneurship, gaining expertise in managing a retail business and handling the responsibilities of meeting payroll and purchasing ice cream cones. Later, he expanded his skill set to include real estate and accounting.

Being a long-time acquaintance of Ken Raffol’s family, Jon joined Ken’s firm at the start of his accounting career. Since 2013, he has specialized in auditing services for not-for-profit entities and preparing IRS form 990 and Massachusetts form PC.

In his spare time, Jon plays the guitar in a band. His dedication to the not-for-profit sector is a significant achievement in his professional journey.

Ken has over 40 years of experience in accounting, operating primarily in Needham and Boston, Massachusetts. He has extensive experience in public accounting firms and also specializes in providing services to closely held businesses and their owners, including auditing, taxation, and business planning. His expertise extends to not-for-profit audits, real estate, and construction management. In addition to his professional achievements, Ken is an accomplished ballroom dancer and holds a 3rd degree black belt in Karate.

Dick specializes in working with small to medium size businesses and not-for-profits. Dick is a member of the Massachusetts Society of Certified Public Accountants and the American Institute of Certified Public Accountants. He serves as treasurer for Carter Memorial United Methodist Church. Dick attended Babson College to obtain his degree in Accounting.

Enrique dedicates himself to preparing financial statements for audits and reviews, performing analytical procedures and substantive testing, and preparing federal and state tax returns. He also handles Uniform Financial Reports (UFR) for the Commonwealth of Massachusetts.

Born in the Dominican Republic, Enrique pursued his studies in the heart of Downtown Boston and studied abroad in Madrid, Spain. Enrique is fluent in Spanish. He moved to Boston at the tender age of 12. During college, he generously volunteered his time as a Spanish-English interpreter and assisted with citizenship applications for the Massachusetts Immigrant and Refugee Advocacy Coalition. Remarkably, he was the youngest applicant to apply for Citizenship in the US with support from Project Citizenship, Inc., an organization with which he is now the lead auditor.

Enrique’s unwavering work ethic extends beyond his professional life. He has recently fulfilled the American dream by moving his family from public housing to their very own brand-new home. Through his dedication and hard work, Enrique has earned the admiration and respect of everyone around him.

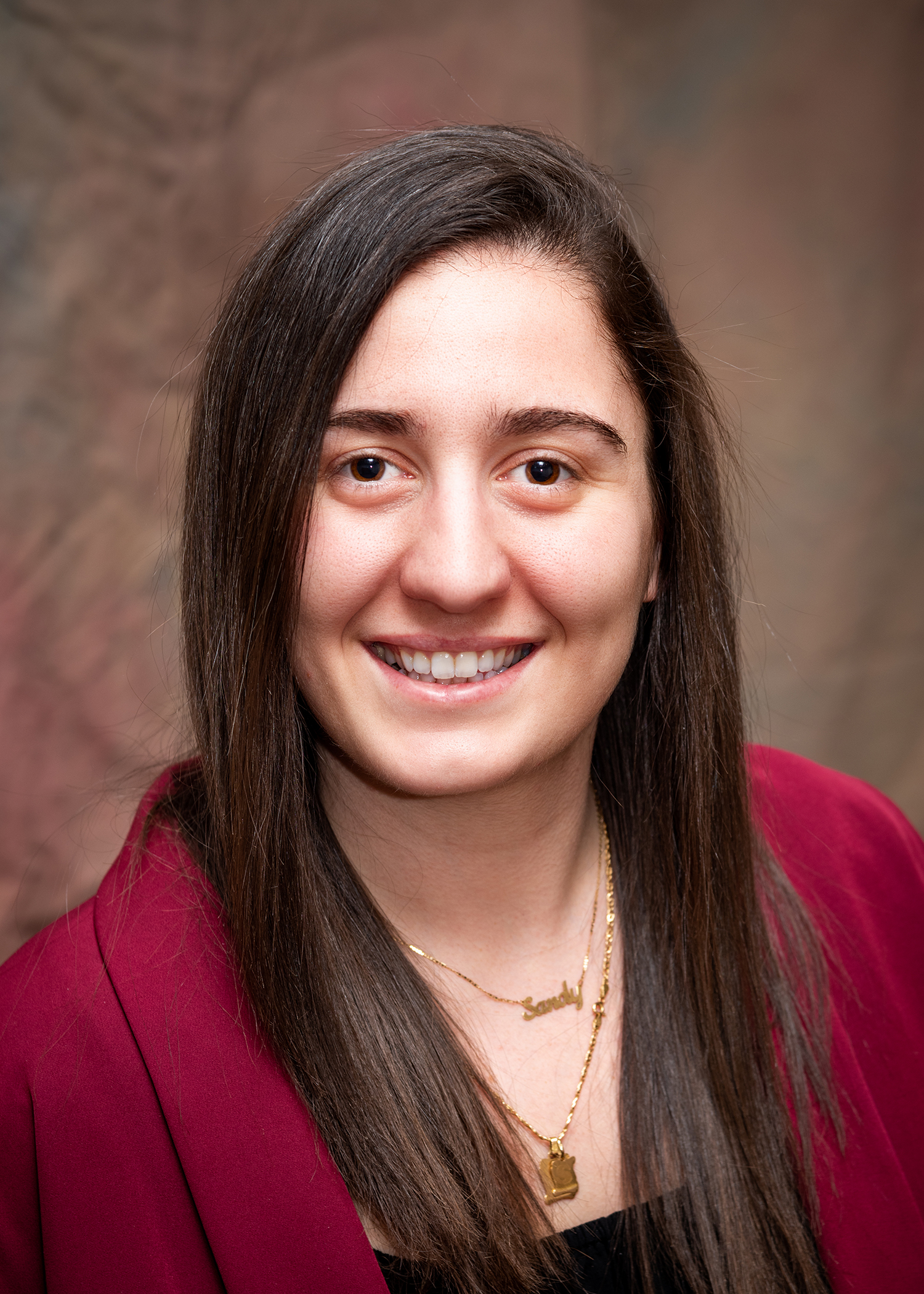

Sandy is experienced in tax preparation, audit, and attest engagements. Originally from Lebanon, Sandy blends a rich cultural heritage with a deep understanding of the financial complexities faced by businesses and individuals alike.

With a strong background in accounting and finance, Sandy has successfully managed a diverse portfolio of clients, ranging from not-for-profit corporations to individual taxation. She holds a degree in Accounting and Finance Management from Northeastern University and a Master’s in Business Management from Monroe College. Her multilingual abilities, including fluency in Arabic, French, and English, allow her to effectively serve a diverse client base.

When she’s not working, Sandy enjoys reading, traveling, exploring new cuisines, and volunteering in the community, reflecting her passion for both personal and professional growth.

Sean has a strong understanding of not-for-profit accounting principles and is responsible for numerous tasks for the firm, including preparing financial statements and grant reports, and testing compliance with applicable laws and regulations. He is also responsible for analyzing financial data to identify trends and make recommendations for improvement.

Sam joined the firm in 2021 as a staff accountant and auditor. He prepares financial statements for audits and reviews, performs analytical procedures and substantive testing in preparation for audits, and prepares federal and state tax returns. Sam also performs Uniform Financial Reports (UFR) for the Commonwealth of Massachusetts. Sam spent 15 years as an Investment Fund Accountant at State Street Investment Bank, then at Bank of New York Mellon prior to joining our team.

Robert Johnson, JD

Legal Counsel

We brought Robert on board to provide legal expertise for our firm. Robert has worked in the prisons on a pro-bono basis as a criminal defense attorney for over 25 years, defending individuals wrongfully accused of crimes. He also worked as an affirmative action officer for the Massachusetts Board of Community Colleges and the University of Massachusetts at Boston.

Robert has published extensively in the field of African American history. Most notable among his books are: Why Blacks Left America for Africa: Interviews with Black Expatriates, 1971-1999, and Nantucket’s People of Color: Essays on History, Politics, and Community. As a playwright, Robert has documented the African American experience with dramas such as, Stop and Frisk, and Mama G. He graduated from Cornell Law School.